Currency Intraday Position Report

![]()

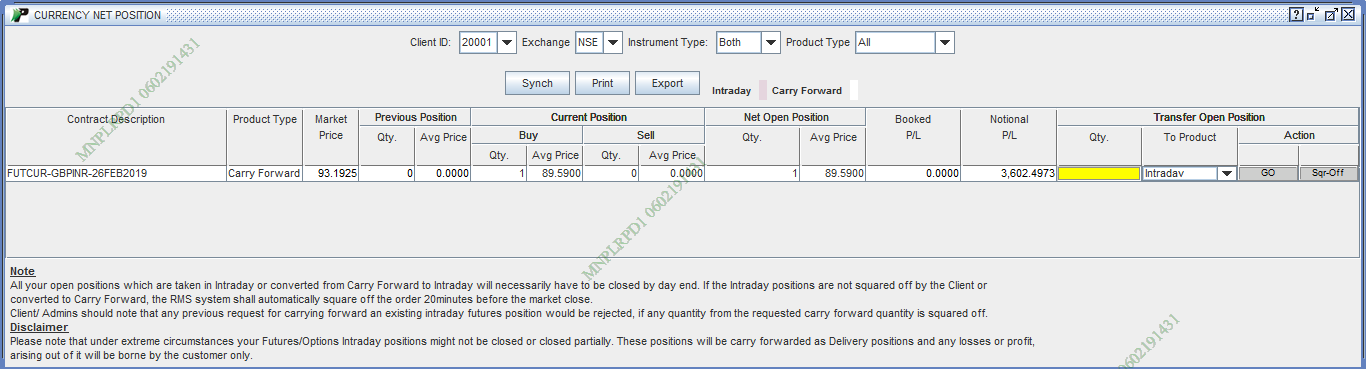

Currency Intraday Report displays a contract-wise summary of your trades for the current settlement in Currency segment. To view records as shown in image below, you need to select value in filters and click on "Sync' button.:

|

How to search a Net position?

You can use the following options to search a position:

- Exchange- You can search position on the basis of exchange. Select the exchange under which you wish to view your Intraday position.

- Instrument Type - You can search positions on the basis of instrument type. Here, you are provided with two instrument types – Futures and Options.

- Product - You can search position on basis of Product. Here, you are provided with two instrument types – Intraday and Carry Forward. If you wish to view records for all products, then you need to select 'ALL' options.

View Change log

Change Log option enables you view the instructions placed by you for "Transfer to Intraday " or "Transfer to Carry Forward ". To know more about this option, click here...

Currency Net Position Report Search Results

Basis on your search criteria, PIB displays you Intraday Position Search Results in the following format:

- Contract Description - This field identifies the contract in which trading was done. Contract Description is generated by joining various identifiers. For ex., for Futures Contracts, Contract Descriptor is created by joining <Instrument Type>-<Symbol>-<Expiry Date>. For Options contract, Contract Descriptor is created by joining <Instrument Type>-<Symbol>-<Expiry Date>-<Strike Price>-<CE/PE>.

- Exchange - This field displays the exchange for the corresponding contract.

- Product Type - This field displays the product type for the corresponding contract.

- Previous Position- Qty This field shows

the number of contracts (in Qty) traded by you during previous

settlements.

- Previous Position - Avg. Price- This

field displays the average price at which the contract was traded during previous settlements.

- Current Position- QtyThis field shows

the number of contracts (in Qty) traded by you during current

settlements.

- Current Position - Avg. Price- This field

displays the average price at which the contract was traded during the current settlement.

- Net Position- Qty This field displays the net open positions in the corresponding contract. It is usually the sum of 'Previous Position - Qty' and 'Current Position - Qty'.

- Net Position - Avg. Price- This field displays the average price of the open positions held by you in the corresponding contract.

- Current Price- This field displays the

current market Price of the corresponding contract.

- Notional P/L -This field will display the notional profit / loss on the open Future & Options positions. For Buy Options positions, notional P/L will be zero, since you have paid the entire premium. For Futures (Buy & Sell) andl Options (Only Sell) positions, Notional P/L will be calculated.

- Booked P/L - This field will display booked profit/loss on squared off positions in the corresponding contract.

- Action-- You can click on Square-Off Net position button to square off your open position in selected currency contract.

Add-on Features

- Sync- You can view intraday position details by clicking on 'Sync' button based on values selected in filters.

- Print - You can take a print out of the

given Currency Intraday position Search table by clicking on ‘Print’ button.

- Export - You can download the given

intraday position details in your PC by clicking on ‘Export’ button. These

details will be downloaded in csv format.

Also Read: