Trade Search

![]()

How Trade differs from an Order ?

The basic difference between an order and a trade is that an order is the request that you have placed to transact in the particular scrip, whereas, a trade is the confirmation that the order is successful and you are one of the beneficiaries of the particular transaction.

About Trade Search Feature

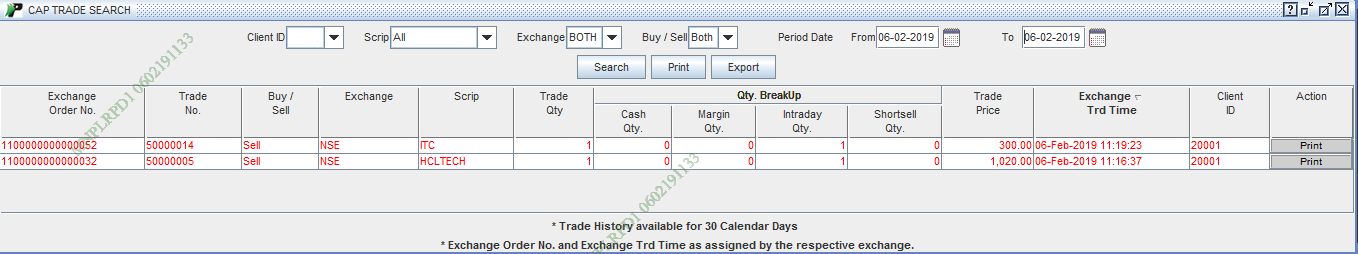

You can use Trade Search Feature to search your trade(s) in the Capital Market. On clicking this option, PIB displays you the

following window:

|

How to search Trade ?

You can use following options to search the desired trades:

-

Scrip - You can search trades related to the particular scrip. Enter the scrip

name for which you wish to view trades. You can also use drop down

menu to choose the desired scrip.

-

Exchange - You can search trades done on the particular exchange. To search in NSE based trades, choose

'NSE' option from the drop-down box. Similarly to search in BSE based

trades, choose 'BSE' option. You can search in both the exchanges by

choosing 'Both' option.

-

Buy/Sell – You can specify whether you

wish to view Buy Trades or Sell Trades. If you are unsure about it, choose ‘Both’ option from the drop-down box.

- From / To- You can view the complete list of trades done between two dates. Specify the date after which you wish to view trade(s) in 'From' field. Similarly, specify the date till which you wish to view trade(s) in 'To' field. These dates will be in (dd/mm/yyyy) format.

Once you set the search criteria, click on ‘Search’ button. On clicking, PIB works on your set criteria and displays you the related trades. (You can read about Trade Search results in the section given below).

Trade Search Results

Basis on your search criteria, PIB displays you Trade Search Results in the following format:

-

Exchange Order No - It displays the order

number against which the corresponding trade was executed.

-

Trade No - It displays the Trade Number.

Note! For NSE, last eight characters of the TRADE NO denote the TRADE

NUMBER, whereas, for BSE, first six digits of Trade No. denote the scrip

code and remaining digits denote the Trade No.

-

Buy/Sell - It displays whether you have purchased the underlying scrip or sold it with respect to corresponding trade.

-

Exchange - It displays the exchange name

where the corresponding trade was executed.

-

Scrip - It displays the name of the

underlying scrip.

-

Trade Qty - It displays the total scrip quantity traded by you.

-

Qty. Breakup - It displays the

quantity-wise breakup of the traded scrips. It indicates the quantity of

scrips traded in Cash, Margin & Intraday segment.

-

Remaining Quantity - It displays the

remaining quantity, which is yet to be traded.

-

Trade Price - It displays the price at

which the underlying scrip was traded. Trade Price is the average price at which the corresponding trade was executed.

-

Exchange Trd.Time - It displays exchange's date and time when the corresponding trade was executed.

-

Client ID - It displays the Client ID who has placed the corresponding trade.

- Action - You can take print out of the corresponding trade by clicking on 'Trade' button. On clicking this button, you will view the Trade Confirmation Report where you can click on 'Print' button to take its print out.

Add-on Features

-

Print - You can take a print out of given Trades Table by clicking on ‘Print’ button.

- Export - You can download the given trade details in your PC by clicking on ‘Export’ button. These details will be downloaded in csv format.

Also Read: