Buy (F&O)

![]()

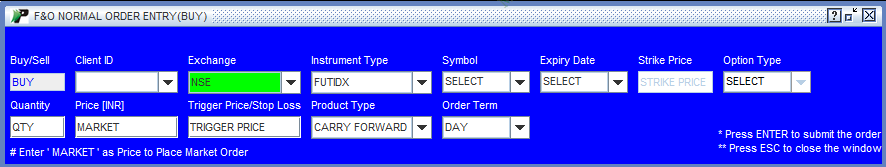

Buy feature lets you buy a Futures or Options (F&O) contract in NSE or BSE exchange. Alternatively, you

can also access this feature by right-clicking on the particular contract in Market Watch and selecting 'Buy Now' option. Note! You can also press 'Shift+F11' key on your keyboard to place a buy order in the F&O market.

|

How to Buy a Contract in NSE?

To buy a Futures/Options contract in NSE, follow the steps given below:

- Exchange - To begin with, choose the Exchange type from the drop-down box. You can choose 'NSE' option or 'BSE' option from the drop down list. By default 'NSE' is selected.

- Instrument Type – Next, choose the

Instrument type. Here, you are provided with four major instrument types – OPTIDX (buy

index options), FUTIDX (buy index futures), OPTSTK (buy stock options) and FUTSTK (buy stock futures).

-

Symbol - Next, enter the symbol name like 'NIFTY' or 'ABB' etc.

-

Expiry Date– Next, choose the expiry date of the selected contract from the drop-down box.

-

Strike Price – This field is only

applicable with Options contract. Here, you can enter the strike price of Options contract.

-

Option Type – This field is only applicable with Options contract. Here, you can choose whether you wish to Call Options contract or Put Options contract. Below table will help you in this perspective:

PositionAnticipationProfitLossBuy - CallUnderlying stock / nifty price will rise in futureUnlimitedOptions Premium

Buy - PutUnderlying stock / nifty price will fall in futureUnlimitedOptions Premium

-

Quantity – Next, enter the contract quantity that you

would like to purchase. Note! You can only enter the quantity in multiples of Lot Size. To buy '1' lot size of the selected contract, you can press

key on your keyboard.

key on your keyboard.

-

Price – Next, enter the price at which you

wish to place the BUY ORDER. To place order at the prevailing market price,

do not change the value in this field i.e., keep the value 'MARKET' in this field.

-

Trigger Price -Trigger Price is the

price at which your order is triggered or placed in the market. In this field,

you can enter the Trigger price.

-

Product Type -The “Product Type” is a dropdown field that have “Carry Forward” and “Intraday” as a product.Intraday trading refers to the trading system where you have to square-off your trade on the same day.

- Order Term – In this field, you choose

the time duration for which you want to place the order in the market. You

are provided with two major options – Day (to place the order till

the End of Day) and IOC (Immediately confirmed or cancelled).

-

Place Order - To place the order, press ‘Enter’ key on your keyboard. Press ESC to close the Buy window.

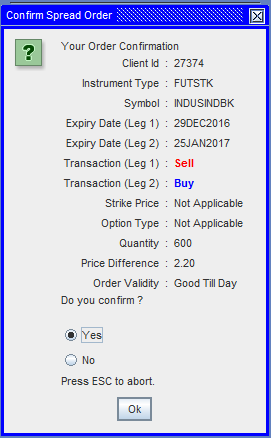

- Confirm Order - Once you press the 'Enter' key, PIB asks you to confirm the order (screenshot given below).

|

Click on “Ok” button to successfully place the order.

Note! If you are transacting for the first time after logging into PIB, you will be asked to enter Transaction Password first. Enter Transaction Password in the displayed text box and click on “Submit” button. The system will verify your transaction password and if finds it to be correct, will display you the Confirmation screen.

Buy Spread (F&O)

Buy Spread lets you buy a Spread contract in Future segment in NSE exchange. Alternatively,

you can also access this feature by right-clicking on the selected spread contract in Market Watch and selecting 'Buy Now' option. Note! You can also press 'Shift+F5' key on your keyboard to place a buy order in the F&O market. If contract is selected in Market Watch, press'F1' key to place buy order

|

How to Buy a Spread Contract in NSE?

To buy a Future Spread contract in NSE, follow the steps given below:

- Client ID - This field displays the client ID through which the user has logged in the account.

- Exchange - To begin with, choose the Exchange type from the drop-down box. Since currently Spread is allowed for NSE only By default 'NSE' is selected.

- Buy Spread/Sell Spread - A Order Type is being provided indicating whether the Spread is a buy spread or a sell order Spread window. Placing buy spread indicates that system will send

first leg order as a Sell Order and second leg orders as a Buy Order in F&O Market and vice versa.

- Instrument type - Next, choose the Instrument type. Here, you are provided with three major instrument types – FUTIDX ( to buy index futures), FUTSTK ( to buy stock futures and FUTIVX (to buy INDIAVIX Contract)

-

Symbol - Enter the Symbol name you want to Buy.

-

Expiry date - The expiry date field would be a dropdown field displaying expiry dates for the selected contract for both the legs.

-

Strike Price – Not Applicable

-

Option Type – Not Applicable.

-

Quantity – The user can enter the no. of Quantity in this field that is to be bought/Sold. The quantity must be in multiple of regular lot size.

-

Price Difference (INR) - The user can enter the price difference as limit price in this field.

-

Validity -The user would be given an option to choose the order term, from the dropdown i.e. Day order or IOC order. Since, IOC

orders are not allowed for spread contracts. The dropdown having Day only as Validity.

- ENTER - Press ENTER to Submit the Order to Exchange. On pressing ENTER you will be asked to confirm the order with “Yes” or “No” option as shown below.Click on “OK” button to place an order.

- ESC - To Close the Order Form window

Order Type |

Contract |

Transaction Type |

Leg 1 Transaction |

Leg 2 Transaction |

Spread |

NIFTY-OCT15NOV15 |

BUY |

SELL |

BUY |

Spread |

NIFTY-OCT15NOV15 |

SELL |

BUY |

SELL |

|

Click on “Ok” button to successfully place the order.

Note! If you are transacting for the first time after logging into PIB, you will be asked to enter Transaction Password first. Enter Transaction Password in the displayed text box and click on “Submit” button. The system will verify your transaction password and if finds it to be correct, will display you the Confirmation screen.

Also Read: