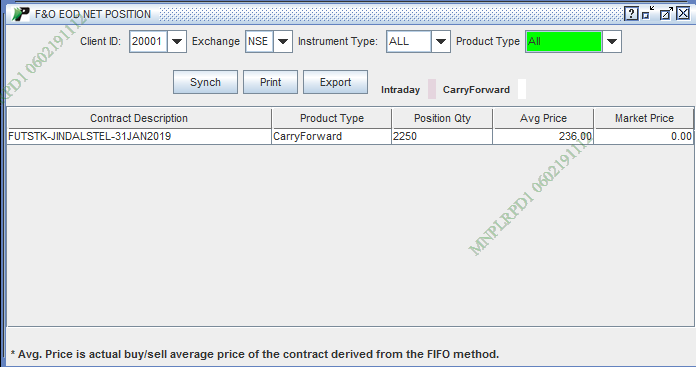

NSE F&O EOD Net Position Report

![]()

NSE F&O EOD Net Positions Report provides details on your Futures and Options (F&O) contracts in NSE that were expired or squared-off at the end of previous trading day.

|

NSE F&O EOD Net Position Report displays you the following details:

- Client ID – In this field, you can select the Client ID.

- Exchange – In this field, you can select the exchange like 'NSE' or 'BSE' from the drop-down.

- Instrument Type – Next, choose the

Instrument type from the drop-down box. Here, you are provided with two major instrument types – Futures and Options.

-

Contract Description - This field identifies the contract. Contract

is generated by joining various identifiers. For ex., for Futures

Contracts, Contract Descriptor is created by joining <Instrument Type>-<Scrip>-<Expiry Date>, whereas for Options Contracts, Contract Descriptor is created by joining <Instrument Type>-<Scrip>-<Expiry Date>-<Strike Price>-<Option Type>.

- Product Type –This field displays the product type for the corresponding contract.

- Market Price – This field displays the current market Price of the corresponding contract.

- Exchange – This field displays the exchange.

-

Position Qty – It displays the number of scrips that were squared-off or expired in the corresponding contract.

Add-on Features

-

Synch - You can click on ‘Synch’ button to synchronize /update Intra-Settlement Report.

-

Print - You can take a print out of

Intra-Settlement Report by clicking on ‘Print’ button.

- Export - You can download the given details in your PC by clicking on ‘Export’ button. These details will be downloaded in csv format.

Also Read: